Never run out of cash with Equals' Runway Model

Abbey Lauren Minondo | | 3 min read

You’ve heard it before and we’ll say it again: cash is king. 👑 If you don’t have a plan for how you’re spending your money, your company won’t last long. Runway modeling can help not only manage spend, but also serve as a great way for figuring out the best time in your journey to consider fundraising.

Get started today by using the same Cash Runway model that we used during the first two years at Equals. Try the template.

🛫 What is “runway” anyway?

Runway is the amount of time your company has, usually measured in months, before you run out of cash. It is calculated by subtracting current and foreseen spend (also referred to as “burn”) from current and foreseen revenue and cash on hand. Investors, executives, and prospective employees will all want to know your cash runway – and having a pulse on how much you’re spending gives you the opportunity to adjust course (by spending more or less) while there’s still time. That way, you’re best prepared to meet your next milestone: closing your next round or reaching profitability.

🔥 What's your burn multiple?

Burn is your cash inflows minus your cash outflows each month, and it can be difficult to know whether you’re being efficient or not with your capital without a benchmark. That’s why the “burn multiple” is a helpful metric: it’s a number that is calculated by taking net burn and dividing it by net new ARR. What this gives you is essentially how much you need to spend to receive a dollar.

For venture-backed startups, David Sacks provides a great rule of thumb for what “good” burn looks like:

❗️️ Why you should care about it?

Your company’s burn multiple is one of the most important metrics investors will look at when you’re fundraising: it is essentially a proxy for how efficient you are at growing your business. For Series Seed and A companies, burn can be tracked by keeping things simple. You’ll want to factor in headcount expenses (who you’ve hired and who you’re planning on hiring), recurring spend (subscriptions to software services, office expenses, etc.), and one time spend (like last month’s company offsite).

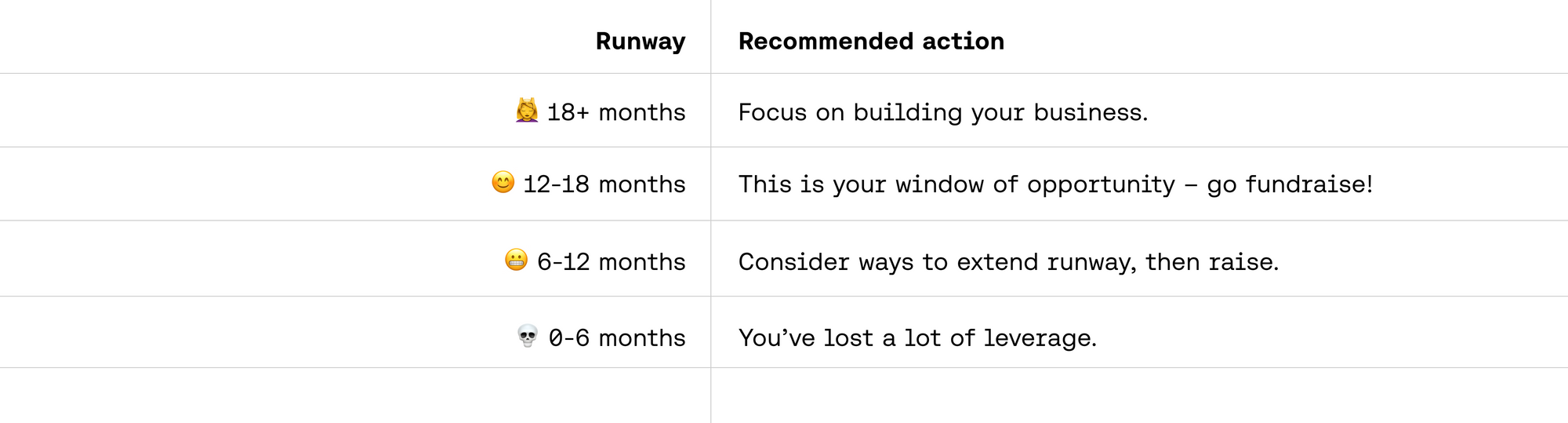

💰 When is the best time to fundraise?

Generally speaking, our advice for deciding when to seek investment breaks down as follows:

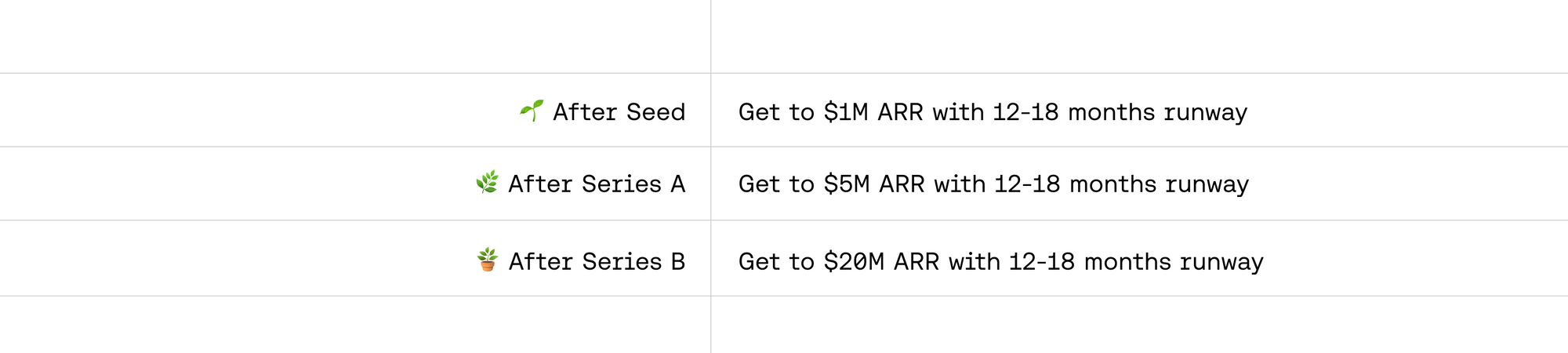

Of course everyone’s business is different and economic times change, but typically investors for venture backed startups will look for companies that fit the following criteria:

📈 Model your Runway with Equals today

Use our Cash Runway template to make sure your spend isn’t getting ahead of your product’s traction.

Once you have your plan in place, you can take things a step further by categorizing spend by departments: COGS (Cost of Goods Sold), S&M (Sales and Marketing), R&D (Research and Development), and G&A (General and Administrative). Setting up this view will allow you to compare your historical P+L statements with your runway model, create department level budgets, and scale intelligently.

Have questions getting started with your cash runway model? Drop us a line, anytime.

By Abbey Lauren Minondo

Business Operations at Equals