Reduce churn by tracking failed payments

Abbey Lauren Minondo | | 2 min read

Did you know that failed payments are the #1 cause of involuntary churn? 😱

How closely are you monitoring failed payments? Not sure? Then you’re probably leaving money on the table.

But hey, don't sweat it because we've got a template for that. Our new Failed Payments Tracker is designed to help you stay on top of revenue owed to your business by giving you real-time insight into what charges failed, why, and who to contact.

Connect to Stripe and try out the template today.

🤔 Why do payments fail?

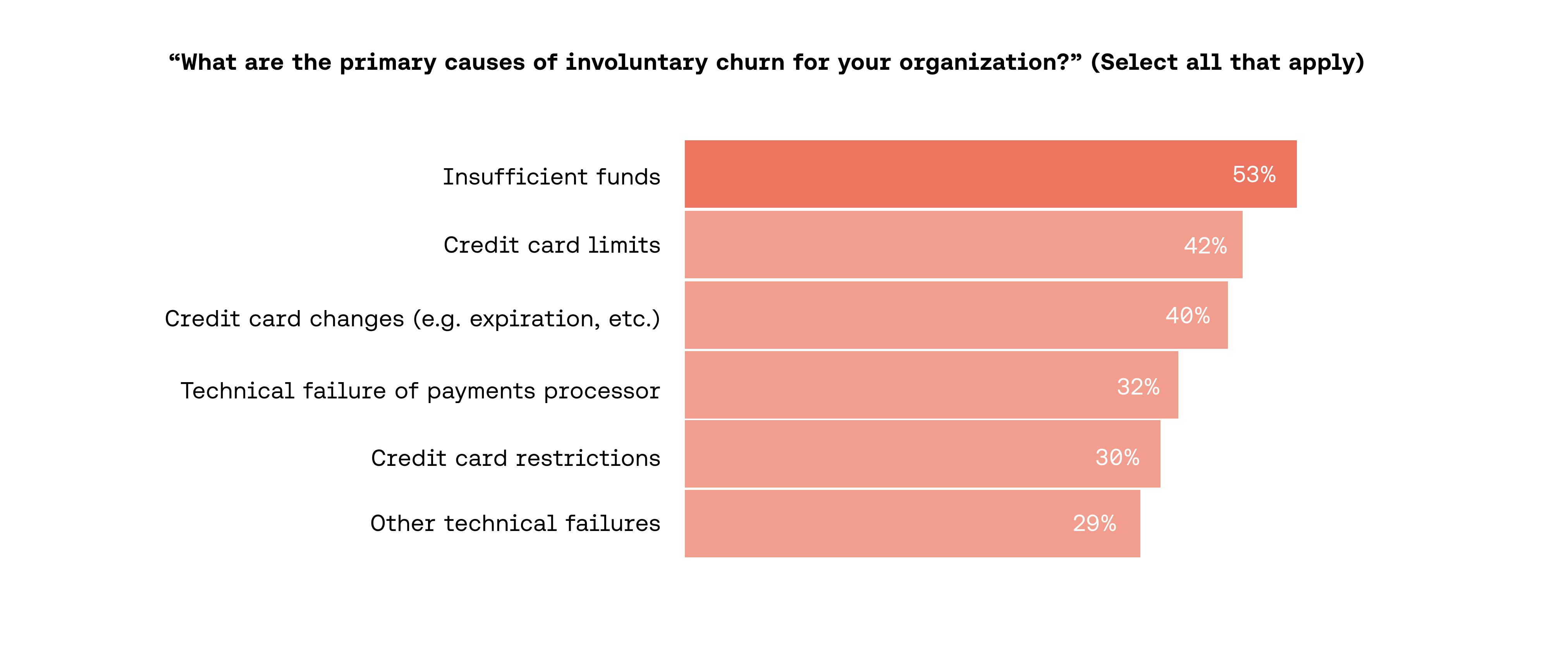

Stripe’s error codes provide a thorough list of the possible reasons why a customer’s payment might not be successful. The leading causes for payment failure can be broken down into six different buckets, with insufficient funds being the primary driver.

🛑 How to prevent payment failure?

While you can't completely prevent all payment failures, you can definitely take steps to mitigate the risk.

1. “Dunning”

Expired cards or inaccurately entered card details (including card number, expiration date, CVV code, or billing address) can be mitigated by alerting clients about upcoming payments.

How? You can send automated emails if a card on file is close to expiring (or has incorrect details) by following Stripe’s instructions here. This process is referred to as “dunning”, and can prove incredibly effective at anticipating issues before they arise.

2. Proactive outreach

Suspicious activity, technical glitches, and insufficient funds make up for the majority of failed payments. While these three drivers are much harder to foresee, they are best resolved with timely outreach from your company to the billing contact, explaining what went wrong and offering simple steps to resolve the transaction. You’ll want to keep a keen eye on these transactions to make sure that they are resolved as quickly as possible.

⛔ What to do if failures occur?

At the end of the day, no matter how well you plan, you’ll likely have a failed payment or two to deal with. In these instances, the best thing to do is to reach out to the billing contact and make it as easy as possible for them to resolve the issue.

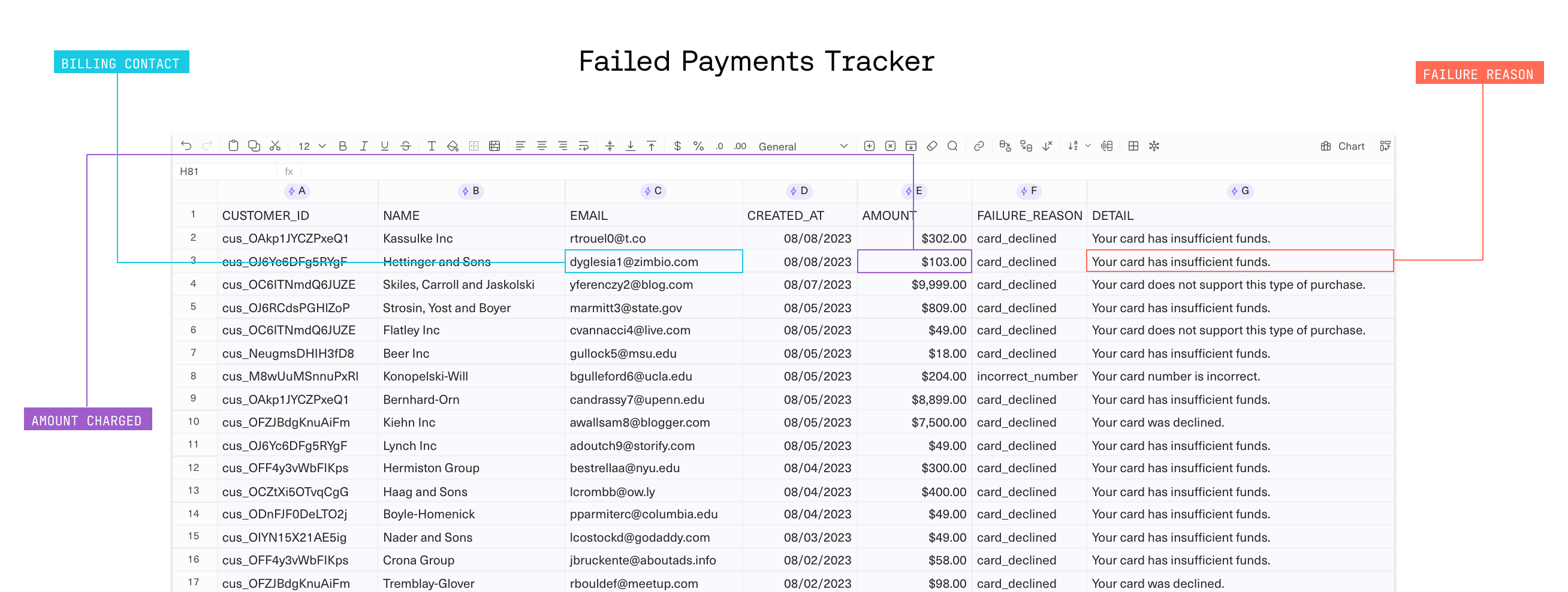

With Equals, you can create a workbook that automatically updates with failed payment data from Stripe so that you always have a real time view of what’s going on. You’ll be able to see the client’s name, the amount charged, email address, and failure reason so that none of your revenue ever slips through the cracks.

Try the Failed Payments Tracker now and stop leaving money on the table.

By Abbey Lauren Minondo

Business Operations at Equals