LTV to CAC: Your key to scaling efficiently

Abbey Lauren Minondo | | 3 min read

You might have heard the acronyms thrown around, but your LTV:CAC ratio isn’t just some fancy alphabet soup for impressing investors. When tracked closely, it’s a great way to benchmark your company's ability to grow sustainably.

And great news, we’ve built the queries you need to get your data from Stripe to feed into your LTV calculations. Calculate your LTV:CAC ratio with Equals today.

ℹ️ LTV and CAC: What are they and why should you care?

Alright, let's get down to business. The LTV:CAC Ratio is like your growth GPS. It compares Customer Lifetime Value (LTV), the revenue that customers will generate over their lifetime, against Customer Acquisition Cost (CAC), the cost of acquiring new customers.

When these metrics converge, they form a powerful ratio that sheds light on your brand's immediate and future profitability, growth potential, and overall value.

🧮 How to calculate LTV:CAC?

No rocket science here, just some simple math. Divide LTV by CAC and you've got your LTV:CAC Ratio.

Now let’s talk about how to get the inputs to this formula.

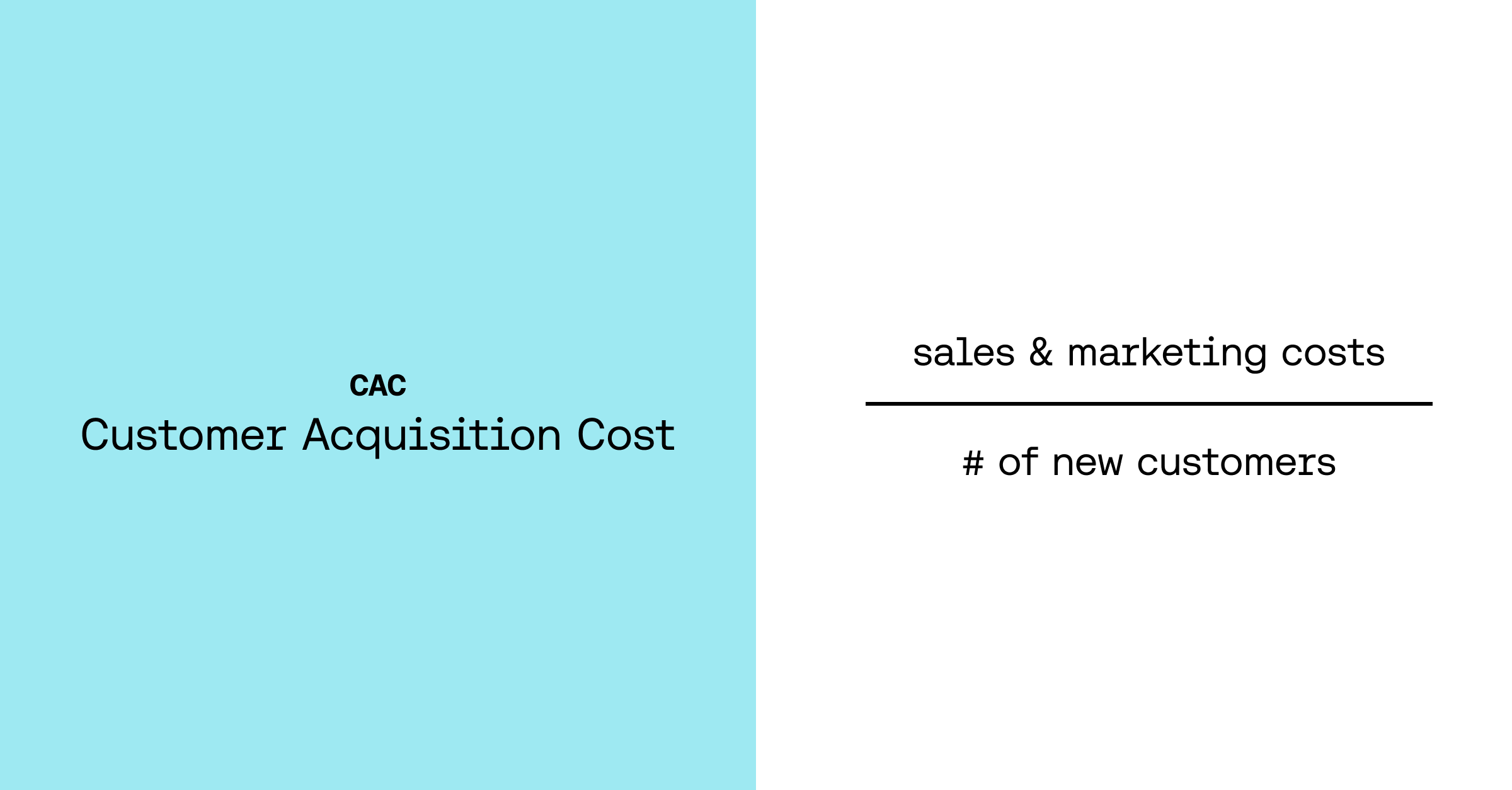

Customer Acquisition Cost

CAC is the average cost of acquiring a single customer. Compute it by summing up total sales and marketing expenses (like ad spend, campaigns, sales commissions) and dividing this by the total new customers obtained within the designated period.

Focus solely on costs directly tied to new customer acquisition, excluding those related to existing customer retention, upgrades, or upsells.

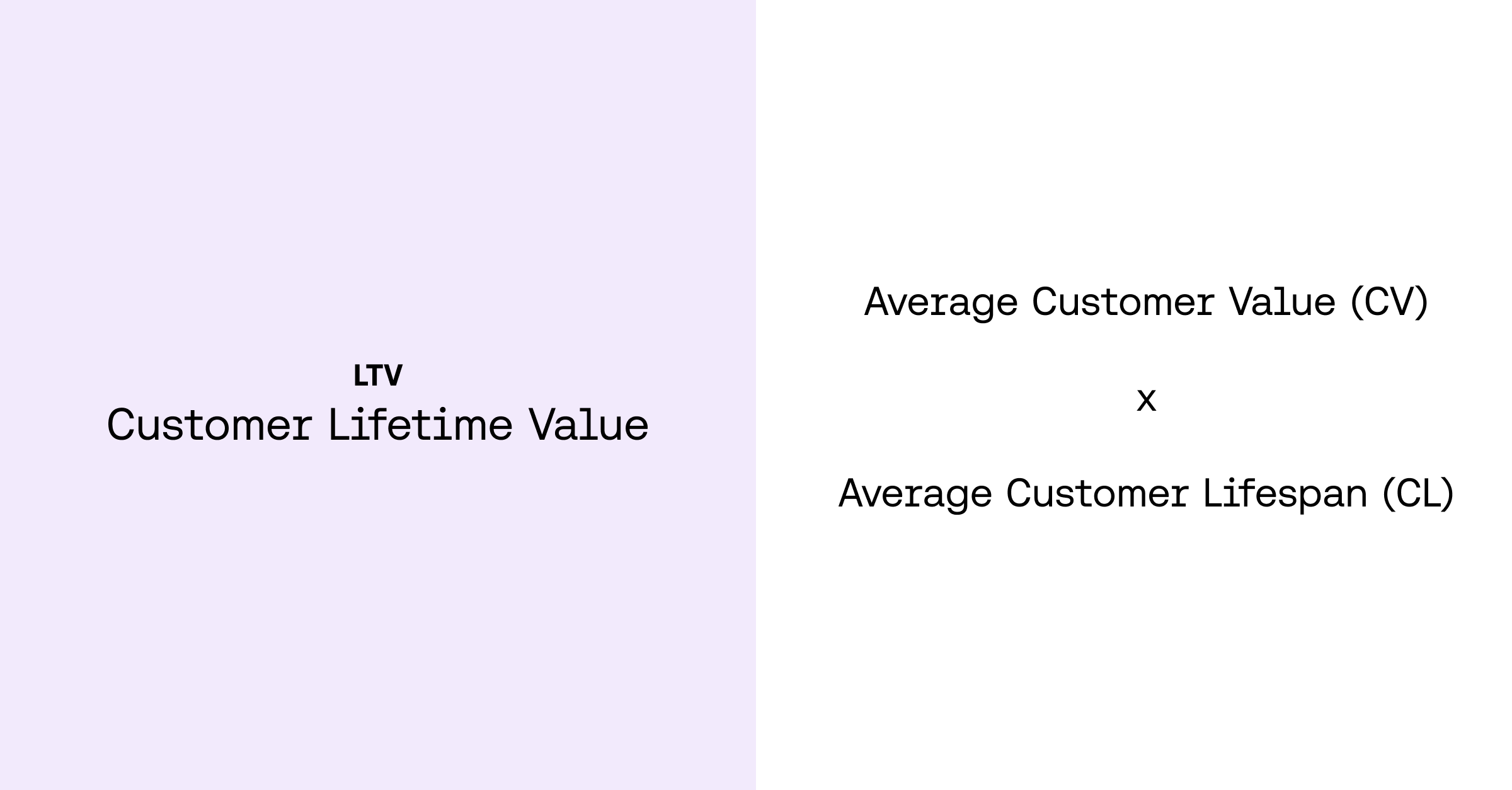

Customer Lifetime Value (LTV)

LTV represents the total revenue anticipated from a customer's initial purchase to their last. This calculation requires regular updates. Calculate LTV by multiplying Average Customer Value by Average Customer Lifespan.

We can use our Net Revenue Retention Cohorts to determine the percent retention for each cohort (or how many dollars your customers continue to pay during a certain period). We can leverage this information by applying a small percent decay to estimate what these customer cohorts will pay in future years. That helps us determine the customer value over their lifespan, which are our inputs for LTV.

🧩 How to interpret (and improve) your LTV:CAC ratio

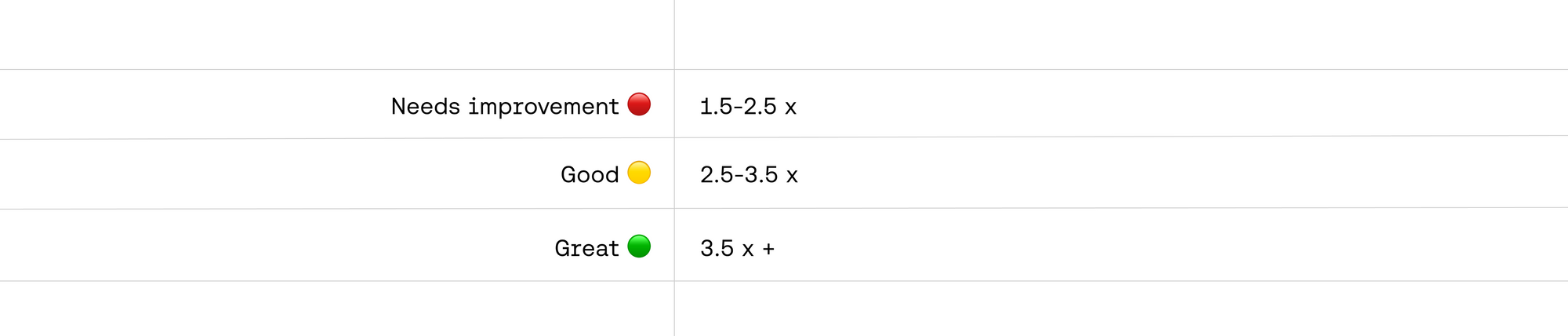

In general, you can benchmark your LTV:CAC performance by relying on the following standards:

Some things you can do to improve your LTV:CAC ratio are:

- Target High-Value Segments

Focus on customers likely to generate more revenue over time by tailoring your efforts to specific segments. - Optimize Acquisition Channels

Prioritize effective channels that attract high LTV customers while adjusting or reducing less successful ones. - Enhance Engagement and Onboarding

Provide smooth onboarding experiences and engage customers through personalized interactions, upsells, and cross-sells. - Emphasize Retention and Satisfaction

Implement retention tactics, loyalty programs, and exceptional service to keep customers engaged and reduce churn.

🌱 Scale more efficiently with Equals

Use our LTV:CAC template to allocate resources wisely by pinpointing customer segments for targeted marketing efforts, adjust pricing based on long-term profitability, and address challenges in customer acquisition or retention before they escalate.

Have questions about getting started tracking LTV or CAC? Send us a note and we’d be happy to help.

By Abbey Lauren Minondo

Business Operations at Equals