The hardest leap to make as a scaling finance leader

Bobby Pinero | | 3 min read

I’m consistently asked how I scaled effectively as the finance leader at Intercom from less than $1M to $150M+ ARR.

The truth is I didn’t.

In the last few years of my 7.5 year journey, there was one big leap I failed to make.

For any finance leader looking to scale through hyper growth, I think it’s the hardest leap to recognize, and that’s because the role of the finance leader changes pretty distinctly as you achieve a certain scale.

The first phase of finance at a startup has a very specific role. I wrote about that in depth here. The first finance hire is not an accountant - it’s not payroll, accounts payable / receivable, or anything else back office. At this stage, the role of finance is to grow the business by putting in place organizing frameworks and by doing analysis.

And for quite some time the role of the finance leader scales along a similar path.

The second phase is a period of intense experimentation. The role of the finance leader is to support decisions by presenting tradeoffs and by providing structure for what otherwise can be a really messy time. This is a period of very literally figuring out what’s working and what’s not - from which you develop the identity and strategy of the business.

Tangibly speaking, in this second phase, finance:

- helps to segment the business by company size, industry, channel, geography, etc.

- helps to create frameworks for experimentation and decision making

- dives deep into customer acquisition, retention, and unit economics

Informed by these analyses, finance is able to paint a picture of where the business is pointed.

As such, the leader at this stage actually looks quite similar to that first hire. At the core of their responsibilities is analysis. And moving from the first phase to the second requires a leader who can scale from being a great analyst themselves to building a high performing team of analysts.

And yet it’s the third phase of scaling finance that’s the hardest and the one in which I failed to make the leap. And it’s because the mindset changes pretty meaningfully.

In this third phase, it’s no longer enough to simply scale up analysis. It’s no longer enough to tell the story of where the business is going as a function of where it’s been.

Instead, the finance leader must paint a story of where the business needs to be - think 5 years into the future! - and then develop alignment on all the actions necessary to get there.

Unlike the first phase, the fear is no longer imminent death. Unlike the second phase, you now have clearly articulated, differentiated strategies to execute against in the short term.

In this phase you’re steering something more akin to a cargo ship. There’s a tremendous amount of organizational momentum. Without clear direction, it will simply charge ahead in whichever direction it’s going. Therefore, like a cargo ship, any change in direction needs ample preparation to reflect the time necessary to steer.

While it’s true that every functional leader needs to make this shift in some capacity, it’s the role of the finance leader to lead the charge.

The first step in embracing this change is in building a plan across a 3-5 year horizon. The annual plan is now just one step along that path. And this 3-5 year plan should reflect where you need to be as a business - informed by your ambitions as a company. For some that might mean achieving a certain valuation. For others it might mean setting up to be a successful public company. For others it might involve a separate north star metric. It could certainly be a combination of all three.

Yet in this stage it’s finance’s role to, in as much detail as possible, outline what it looks like to achieve that ambition. Finance needs to lay out as many of the key metrics needed to achieve that ambition, work backwards on how to get there, and partner with every function to align on the strategies to make that plan reality.

My biggest mistake: I continued to think about the business in terms of where we were. It was what I was used to. I had spent so much time over the first two phases trying to unpack how the business in its past and current state, that it became my default.

If you're a finance leader looking to scale through hyper growth, I challenge you to think about how quickly you can shift into this third phase. Do so as soon as your business and team can support it.

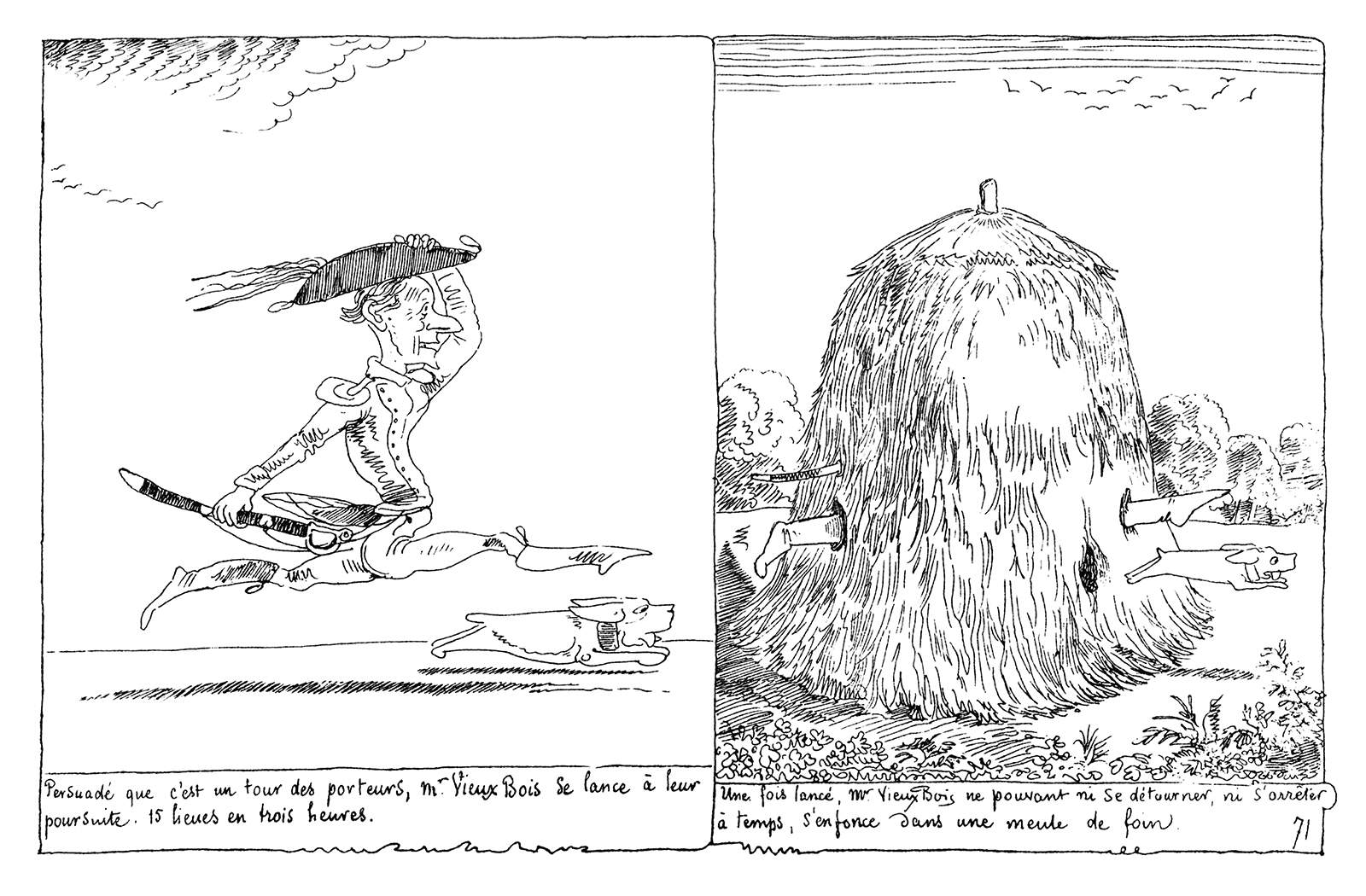

Image credit: https://www.oldbookillustrations.com/illustrations/haystack/

By Bobby Pinero

CEO and Co-Founder of Equals.