Why are SaaS companies valued on revenue multiples?

Bobby Pinero | | 6 min read

Update:

Over the past couple of years, interest rates have increased significantly, causing revenue multiples to meaningfully decrease. The analysis we're sharing here still stands strong, in which we derive revenue multiples from first principles. Were you to regenerate this post, we'd only need to adjust the discount rate applied to future cash flows to derive revenue multiples that match today's economic environment (we will do so in a future post!).

Summary:

Ever scratched your head, wondering why SaaS companies get valued on revenue multiples instead of earnings? This blog post is all about finding the answer to that question!

SaaS companies are a special breed of company because they don't make money right off the bat - they're intentionally not profitable for a while. With earnings out of the picture, we turn to revenue multiples as a quick and easy way to compare SaaS company valuations.

Let's dive in:

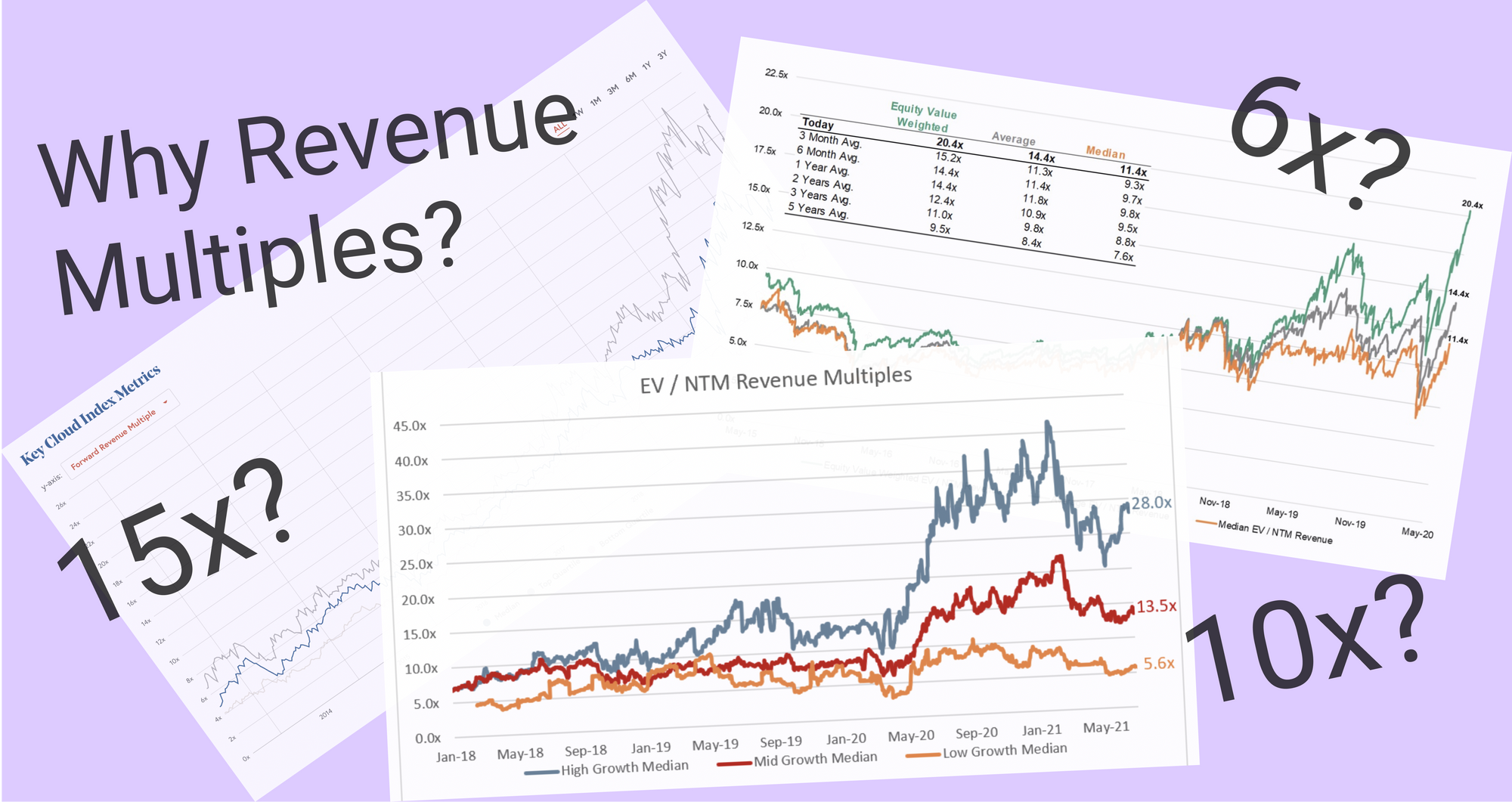

Ever wonder why SaaS companies are valued using revenue multiples when every other business is valued on earnings? Or why SaaS revenue multiples are 6x, 7x, 10x, 20x!?

No, just me? 😅

I set out to figure out why, and I had a lot of fun along the way.

I ended up exploring a possible way to derive a SaaS company’s revenue multiple from their growth and unit economics. Also, a big thank you to my friends at William Blair, namely Bhavan Suri and Dylan Becker, who helped think through much of this.

In this post I will try to answer three questions.

1. Why are SaaS companies valued on revenue multiples instead of earnings?

2. Can we derive a revenue multiple?

3. What should revenue multiples be at different growth rates?

Let’s jump in.

1. Why are SaaS companies valued on revenue multiples instead of earnings?

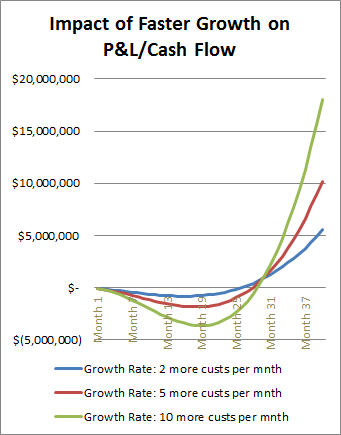

The answer here is relatively simple. SaaS companies are a unique business model in that they do not accrue earnings upfront - they are intentionally not profitable for quite some time. A great primer on this is David Skok's post on SaaS metrics. Here's how he describes the cash flow of one customer within a SaaS business.

And the impact that faster growth has on immediate cash flow.

As a result, while SaaS businesses pursue growth, earnings are a poor indicator of potential and value. It's why lifetime value (LTV) and cost of acquisition (CAC), also known as unit economics, are the true measures of profitability and scalability for any SaaS business.

In the absence of earnings, and given the complexity behind calculating LTV and CAC, we've settled on revenue multiples as a shorthand to compare relative SaaS company valuations. But how did we get to revenue multiples of 6x, 7x, 10x, 20x? Which brings us to our second question…

2. Can we derive a revenue multiple?

The short answer; yes and one way to get there is via unit economics. Let’s walk through an example.

Take a business who has a 5x LTV/CAC (which also happens to be the median LTV/CAC of publicly traded SaaS companies*). A 5x LTV/CAC ratio means that, net of gross margin, that company spends ~20% of their lifetime value to acquire that customer on sales and marketing.

Let’s also assume that the same company has an 80% gross margin, spends 20% of revenue on research and development (R&D), and 14% of revenue on general and administrative (G&A) (all approximately the medians for publicly traded SaaS companies). You can get to a model that generates approximately $30 of lifetime profit (oftentimes called contribution dollars) for every $100 of lifetime revenue. See math below:

So what would you pay then for a business that is not growing and can generate $30 predictably? Let’s say this business had a P&L that looked as follows:

Run this through a discounted cash flow model and you’d pay anywhere between 10 and 20 times earnings (assuming a 5-10% discount rate). Not coincidentally, 10-20x earnings is around where historical price to earnings (PE) ratios have trended for stable, no growth companies.

Now we can get our revenue multiple. Earnings of $30 multiplied by 10x gives us a $300 valuation. Earnings of $30 multiplied by 20x gives us a $600 valuation. Now we have a valuation we can divide by revenue to get a revenue multiple. In this case it's $300/$100 and $600/$100, giving us a range of 3x to 6x revenue to value this company.

In simple terms then, a zero growth, predictable business with a 30% operating margin should command a 3-6x revenue multiple. Bringing us to our third and final question...

3. What should revenue multiples be at different growth rates?

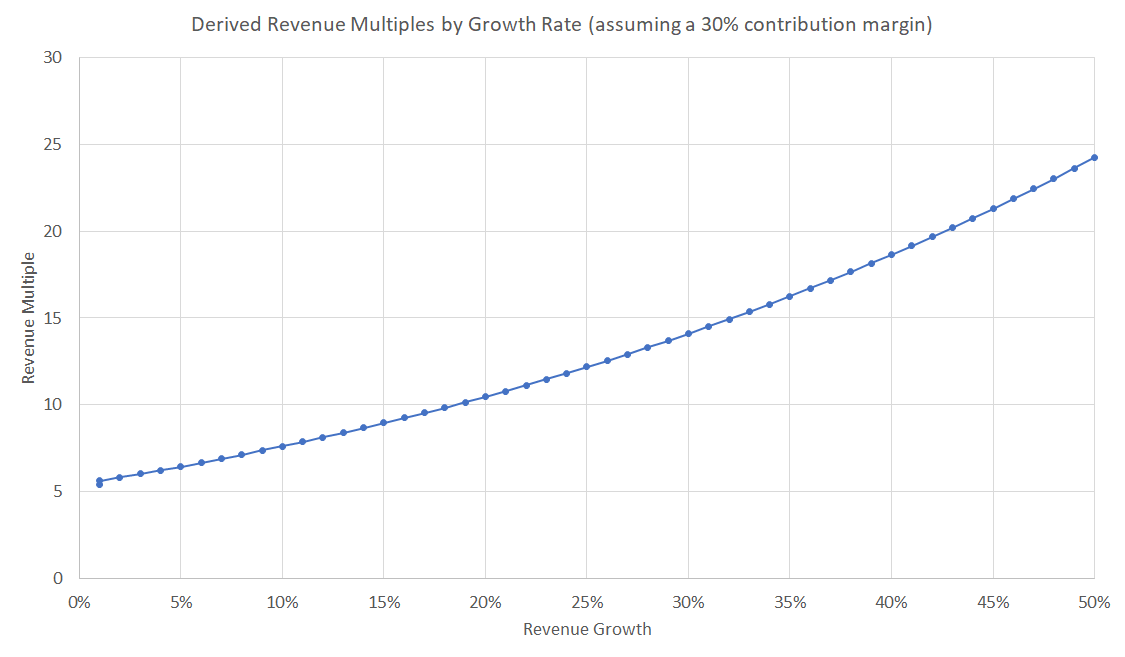

Let’s take our same discounted cash flow model and assume that we’re able to grow revenue (over the next 5 years) and maintain our contribution margin of 30%. Carrying forward the math from above we’re able to generate revenue multiples based on different growth rates.

Assuming a contribution margin of 30%, this then implies that a SaaS business growing annually:

- 10% should trade at ~8x revenue

- 20% should trade at ~11x revenue

- 30% should trade near 15x revenue

- 40% should trade near 20x revenue

- 50% should trade near 25x revenue

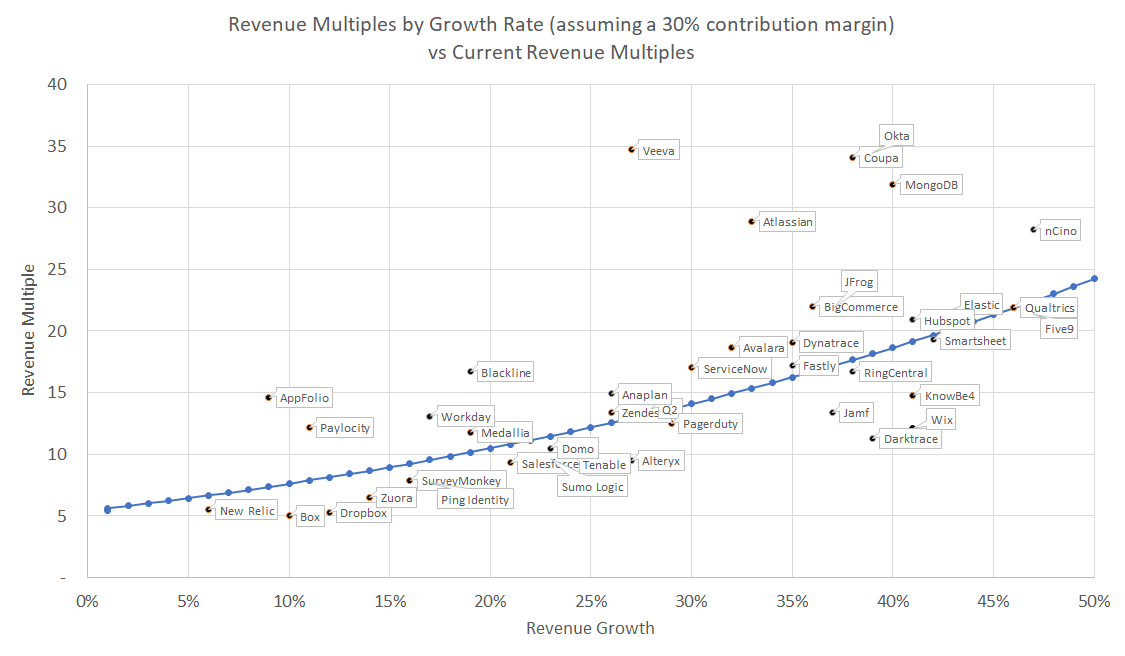

Next, I went and plotted every SaaS business growing up to 50% YoY (actual multiples as of June 4th, 2021). It’s pretty close!

While not perfect, I was quite interested to see how this line pretty closely fits to the valuations currently supported by the market.

For any individual company, the most obvious way to explain variance from the calculated curve is via their actual contribution margin. Remember, my calculated curve assumes a 30% margin. Veeva, for example, has a contribution margin of nearly 50%. On the other hand, Dropbox has a contribution margin of around 15%. Other factors also impacting valuation could be expected future revenue growth (accelerating or decelerating relative to current), brand, TAM growth, and competitive dynamics.

From this exercise we can now see that there’s a way to derive revenue multiples from expected profitability. Amongst many reasons, this solidifies LTV/CAC as a critical ratio for SaaS companies - and is an argument for 5x being a benchmark. It also explain why SaaS businesses must focus on gross margin, R&D, and G&A spend as a % of revenue as indicators for its future earning potential. Just like any other business in the world, SaaS valuations ultimately come back to earnings.

* Note on LTV/CAC. I calculated median LTV/CACs as 5x with the following methodology. I first calculated an estimated payback period as (S&M spend) / (incremental gross profit dollars) in years. Then I applied different LTV time frames depending on product and end markets. SMB inherently has higher levels of churn implying lower LTV and roughly speaking SMB typical churn in mid-teens so that implies a 5-7 year customer life. Mid-market churn tends to be closer to that 10% range or better, so call it a 10 year average customer life. Enterprise customers tend to be the stickiest, with the best companies having sub 5% churn here so call it 12-15 years. Using those ranges, I then divided their payback period by their expected lifetime to get an LTV / CAC ratio.

Image credit:

https://www.meritechcapital.com/blog/q1-saas-earnings-and-valuation-review

https://cloudedjudgement.substack.com/p/clouded-judgement-7221

https://cloudindex.bvp.com/

By Bobby Pinero

CEO and Co-Founder of Equals.